Softone Accounting Suite

Go digital and improve the way you run all your daily tasks.

Take advantage of the capabilities of your people, leveraging the modern technologies offered by the first integrated accounting office management platform and earn more by offering upgraded services to your clients.

All accounting office functions in a single application, focusing on the real needs of the accountant

Ease of use

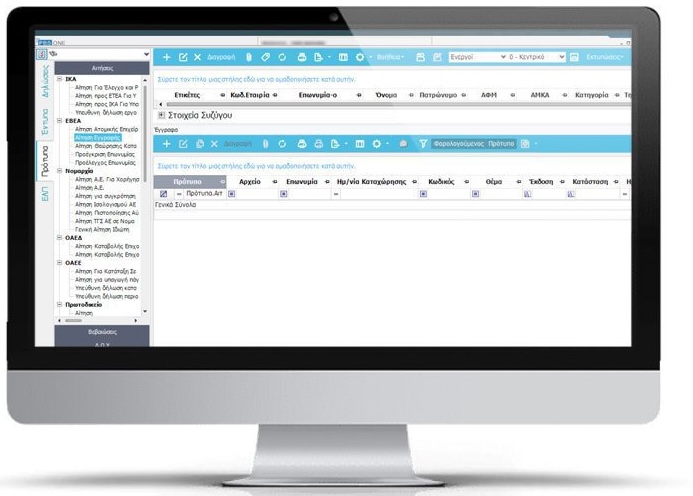

The impressively user-friendly interface of the brand new SOFTONE ACCOUNTING SUITE allows you to do more more easily, with fewer manual entries and clicks. The new simplified work screen enables you to instantly run all your daily tasks faster and more reliably than ever.

Speed

Forget about time-consuming tasks! Take advantage of the possibilities created by the new technologies of SOFTONE ACCOUNTING SUITE and completely simplify your work. Increase your productivity and save significant time and money every day, serving your customers even better.

Reliability

SOFTONE ACCOUNTING SUITE utilizes modern practices and standard models that transform the management of your accounting office into a secure process. Ensuring full compliance with the applicable regulations, SOFTONE ACCOUNTING SUITE also provides maximum security and reliability in the management of your clients' data.

Unique advantages from the first moment!

From the speed of processing requests, to ease of use, security, protection against errors and adherence to schedules, SOFTONE myCLOUD changes the way you have operated until now.

All accounting office functions in a single application, focusing on the real needs of the accountant

- C category bookkeeping

- B category bookkeeping

- Payroll

- myDATA

- Tax Services

- One-Click send

- Forms

- Bulk electronic services

- Templates

- Financial statements of ELP

All accounting office functions in a single application, focusing on the real needs of the accountant

Integrated accounting and tax management for businesses with double-entry books.

Full connectivity, cutting-edge technology, maximum speed and ease of use, completeness of processes, create today an accounting office of tomorrow.

All accounting office functions in a single application, focusing on the real needs of the accountant

Integrated accounting and tax management for businesses with simple books.

Full connectivity, cutting-edge technology, maximum speed and ease of use, completeness of processes, create today an accounting department of tomorrow.

All accounting office functions in a single application, focusing on the real needs of the accountant

A comprehensive Payroll System, which provides every modern accounting office with another powerful tool for implementing the digital transformation of its operation.

Effective management of your clients' payroll needs, with a modern and user-friendly application, easy and simple!

Employee management

Insurance funds

Special functions

Printing

Accounting information

Labor relations

Collective agreements

Connection with banks

Multi-company

IKA forms

SEPE forms

Withholding tax forms

All accounting office functions in a single application, focusing on the real needs of the accountant

SOFTONE ACCOUNTING SUITE is fully aligned with the changes brought about by Electronic Books (myDATA).

Through the application, you can specify, send and synchronize all the necessary data for the correct completion of Electronic Books (myDATA).

All accounting office functions in a single application, focusing on the real needs of the accountant

Fast, easy and accurate completion of all personal and legal income tax forms via retrieval from TAXIS.

Includes all tax forms (E1, E2, E3, ΦΕΝΠ, E9 ENFIA, Profit Collection, A21, EFA, etc.) as well as a newly designed capital consumption form with automatic update from the declarations submitted to Taxis for as many years back as the tax experts wish.

Maintains a permanent and stable record of taxpayers and all forms submitted for them per year

Automatic connection and submission of forms to TAXIS with the click of a button

E1 with LIVE settlement

◦ New unique service that calculates in real time the taxpayer's payment or refund amount, the amount of tax receipts, the amount of receipt deficit, the pre. difference of assumptions, the A21 child allowance and other elements of the settlement.

◦ Automatic monitoring-control of changes in the amounts of Earnings Certificates in E1-TAXIS. Bulk for all registered E1.

◦ Ability to import the pre-filled fields of TAXIS (Earnings, dividends, interest, children, real estate, cars, etc.).

◦ Automatic calculation of A21 child allowance.

◦ Automatic calculation of the amount of tax-free receipts.

◦ Automatic calculation of capital consumption (where required to cover assumptions), so that the payment tax is reduced or the tax refund is increased or the child allowance is increased and all this is seen by the user Live through the Live settlement.

◦ Automatic separation and calculation of the clearance of the farmer by profession in case a taxpayer has income from two or more sources at the same time (e.g. Agricultural income and wages, or Agricultural and rent or Agricultural and pension from the former OGA).

◦ Ability to quickly register a form with only a code and amount for clearance control and export of results.

E2

◦ New unique service that calculates in real time the amount of payment or refund of the taxpayer, the amount of tax receipts, the amount of the receipt deficit, the pre-existing difference of documents, the A21 child benefit and other details of the clearance.

◦ Automatic monitoring-control of changes in the amounts of Earnings Certificates in E1-TAXIS. Bulk for all registered E1.

◦ Ability to import pre-filled fields of TAXIS (Incomes, dividends, interest, children, real estate, cars, etc.).

◦ Automatic calculation of A21 child allowance.

◦ Automatic calculation of tax-free receipt amount.

◦ Automatic calculation of capital consumption (where required to cover assumptions), so as to reduce the tax payment or increase the tax refund or increase the child allowance and all this is seen by the Live user through the Live settlement.

◦ Automatic separation and calculation of the settlement of the professional farmer in case a taxpayer has income from two or more sources at the same time (e.g. Agricultural income and wages, or Agricultural and rents or Agricultural and pension from the former OGA).

◦ Ability to quickly register a form with only a code and amount for clearance control and export of results.

E3 - Tax reform

◦ Import of value fields from the Taxis form.

◦ Automatic import of agricultural subsidies into the E3 form through the OPEKEPE and ELGA payment disclosure system.

◦ Simultaneous preview of the certificate with the ability to print and save it.

◦ Automatic transfer of Green subsidies from E3 to E1 where required.

◦ Automatic import from GL, Revenue-Expenditure.

ΦΕΝΠ

◦ Import of ΦΕΝΠ data from TAXIS.

◦ Automatic adjustment of profit distribution in case of loss transfer from previous years.

◦ Ability to send form N with the accompanying forms E2 and E3.

◦ Support for automatic creation of a certificate of receipt of profits by importing from form N.

E9

◦ Actual sending with automatic completion of all fields in TAXIS and automatic synchronization of any changes during the sending process.

◦ Retrieval of E9 data from Taxis.

◦ Automatic extraction of coefficients from Proaxies for direct calculation of objective values and export of ENFIA real estate tax returns.

Capital consumption

◦ Automatic completion from TAXIS E1 declarations.

◦ Automatic calculation of assumptions.

◦ Retrieve all additional tables of E1, Cars, Real Estate, Boats, Swimming Pools etc.

◦ Support for cases of pensioners over 65, Widowhood, Divorce etc.

◦ Transfer amounts from Obligor to Spouse and back with one click.

◦ 2 printing formats, simple and detailed.

All accounting office functions in a single application, focusing on the real needs of the accountant

A subsystem that adds a series of additional functions that fully automate the execution of time-consuming daily tasks. One-Click Send Advanced includes the following features:

Detailed status of actions

Standard selected forms

Send from anywhere

Personalized emails

e-Notifications

All accounting office functions in a single application, focusing on the real needs of the accountant

Complete management of all forms, giving the user the ability to manage all internal processes from a single screen.

VAT

Registration forms

ΚΒΣ forms

Surplus value forms

Withholding tax forms

All accounting office functions in a single application, focusing on the real needs of the accountant

Public Lotteries

Traffic Tax

POS Obligation

Oil Allowance

Social Tariff

Farmers' Relocation

Uninsured Vehicles

Housing Allowance

Professional Accounts

ENFIA

120 Installments

All accounting office functions in a single application, focusing on the real needs of the accountant

Get access to more than 120 categorized forms for easy search and identification such as:

applications (to IKA, prefecture, OAED, OAEE, etc.)

certificates (certificates of board remuneration, certificate of freelancer remuneration, dividends, DPO designation, etc.)

statutes (standardized statutes of all types of companies, company solution agreements, etc.)

minutes (minutes of various types for SA, LTD)

lease agreements (lease agreements for business premises, residence, etc.)

agreements (agreement for the provision of accounting work, provision of independent services, security technician work, etc.)

These forms interact with the rest of the application to extract data and automatically complete them, are fully customizable by the user and can be changed depending on the needs. The user is also given the opportunity to create and categorize new forms to meet any internal or external need.

All accounting office functions in a single application, focusing on the real needs of the accountant

A program fully harmonized with Law 4308/2014.

With all the forms provided (Balance Sheet forms (B1.1, B1.2, B5, B7.1, B7.2, B11), profit and loss statement forms (B2.1, B2.2, B6, B8.1, B8.2), statements of changes (B3, B9), cash flows (B4, B10), progress statement (B12)) as well as auxiliary forms (appendices, tables of fixed assets and inventories, distribution sheets) Automatic update with import of data from other market programs and various file types or even simple entry Export of forms to all known file types (xls, pdf, etc.)

If you are interested, fill out the form and we will contact you.